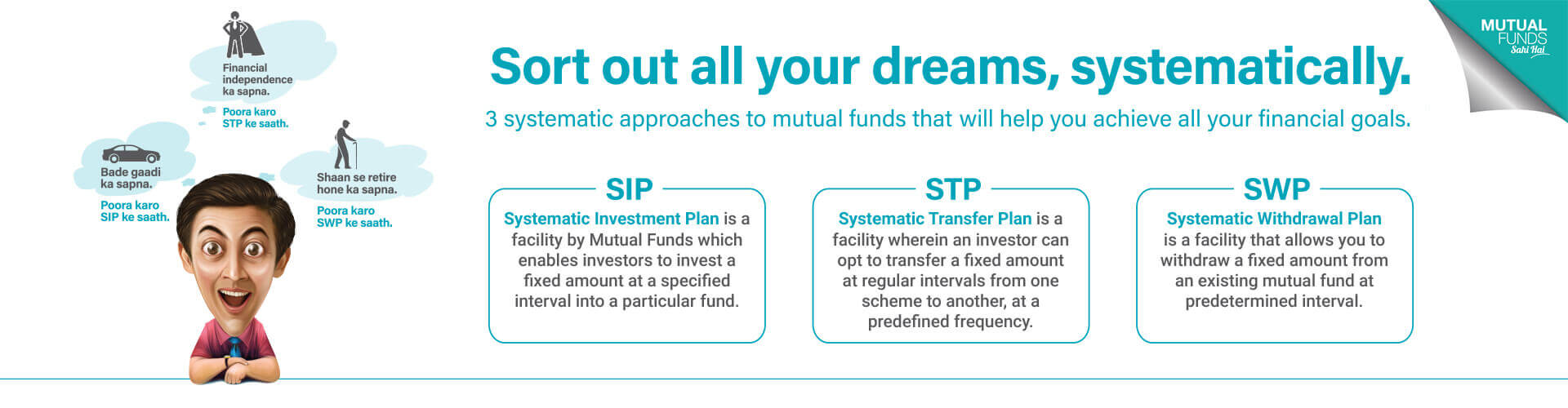

What is SIP??

Systematic Investment Plan (SIP) is a facility offered by Mutual Funds

which enables investors to invest a fixed amount at a specified interval into a particular fund.

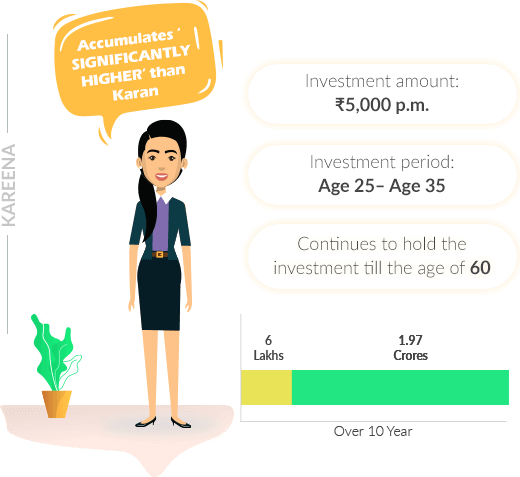

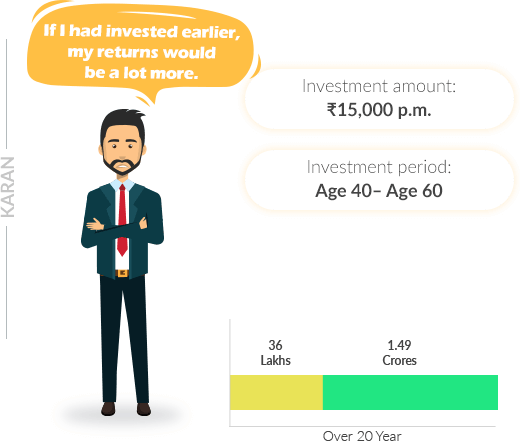

Why Invest Early?

Higher investment amount cannot compensate for the growth potential of starting early!!! (An illustration)

- Total investments

- Investment value @ 60 years

Investing at different stages

Consider the following scenario wherein ₹5,000 is invested every month till the age of 60 years.

- Investment amount `5000 p.m

- Period of investment: Till the age of 60 years

- Assumed growth rate: 12%

Even a delay of 5 years in Investments can reduce wealth considerably

The above calculation is an example only for illustration purposes, purely to explain the effect of compounding on investments over a long term.

The growth rate of the investment is assumed at 12%. Please

note the growth rate mentioned above is purely for illustration purposes only & shall

not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund

Calculate how much your small steps today will mean in the future.

Find out the expected future value of your small investments made today.

Total SIP amount invested

Growth / Appreciation

Expected investment value

Disclaimer :The calculator, based on assumed rate of returns, is meant for illustration purposes only. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and/or safeguard of capital. In the preparation of the calculator, CRAMC has used information that is publicly available and information developed in-house. Information gathered and material used in this calculator is believed to be from reliable sources. CRAMC however does not warrant the accuracy, reasonableness and/or completeness of any such information. While utmost care has been exercised while preparing the calculator, CRAMC does not warrant the completeness or guarantee that the achieved computations are flawless and/or accurate and disclaims all liabilities, losses and damages arising out of the use or in respect of anything done in reliance of the calculator. The examples do not purport to represent the performance of any security or investments. In view of individual nature of tax consequences, each investor is advised to consult his/ her own professional tax advisor before taking any investment decision.

Figure out the right financial amount required

to achieve your financial goal through the SIP amount calculator

You would need to make monthly SIP of

Disclaimer :The calculator, based on assumed rate of returns, is meant for illustration purposes only. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and/or safeguard of capital. In the preparation of the calculator, CRAMC has used information that is publicly available and information developed in-house. Information gathered and material used in this calculator is believed to be from reliable sources. CRAMC however does not warrant the accuracy, reasonableness and/or completeness of any such information. While utmost care has been exercised while preparing the calculator, CRAMC does not warrant the completeness or guarantee that the achieved computations are flawless and/or accurate and disclaims all liabilities, losses and damages arising out of the use or in respect of anything done in reliance of the calculator. The examples do not purport to represent the performance of any security or investments. In view of individual nature of tax consequences, each investor is advised to consult his/ her own professional tax advisor before taking any investment decision.

This calculator will help you visualize the amount accumulated

with regular investment with an increase of your SIP amount (SIP Top-Up)

Total future valuewith SIP Top-up

Total amount invested

Growth / Appreciation

Expected investment value

Total future valuewithout SIP Top-up

Total amount invested

Growth / Appreciation

Expected investment value

Disclaimer :The calculator, based on assumed rate of returns, is meant for illustration purposes only. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and/or safeguard of capital. In the preparation of the calculator, CRAMC has used information that is publicly available and information developed in-house. Information gathered and material used in this calculator is believed to be from reliable sources. CRAMC however does not warrant the accuracy, reasonableness and/or completeness of any such information. While utmost care has been exercised while preparing the calculator, CRAMC does not warrant the completeness or guarantee that the achieved computations are flawless and/or accurate and disclaims all liabilities, losses and damages arising out of the use or in respect of anything done in reliance of the calculator. The examples do not purport to represent the performance of any security or investments. In view of individual nature of tax consequences, each investor is advised to consult his/ her own professional tax advisor before taking any investment decision.

SIP Top-up vs SIP Investment

7 Reasons to Start a SIP

An SIP is a smart way to invest in Mutual Fund to fulfill long-term goals and build wealth.

Here are 7 reasons why you should start an SIP as early as you can

Brings inDiscipline

Invest on a pre-set date every month. This makes you set aside a fixed sum of money to invest in and gradually turns you into a disciplined investor.

Rupee costAveraging

If the markets go up, you end up benefiting, but when the markets go down, you still benefit by getting more units. Thus you average out the cost of buying units.

Power ofCompounding

The longer you stay invested, more is the benefit of compounding. It is like earning interest on interest. Hence start a SIP early & enjoy the power of compounding.

SIP offerConvenience

You can invest a small amount without impacting your household budget.

TimingMarket

Investing through SIP helps you avoid timing the market.

Achieve financialGoals

SIP is a smart tool that helps break your big goals into small amounts. Ascertain the investment amount & start investing regularly through a SIP to realise your dreams.

InvestmentFrequency

You can select the frequency and amount as per your convenience and need.

How SIP Work ?

An SIP by investing a fixed amount at regular interval, you can take advantage of the market volatility.

By investing at different NAVs the average cost per unit comes down.

This is also known as Rupee Cost Averaging.

| Regular investment (`) | Unit price (`) | Units acquired |

|---|---|---|

| 2000 | 10 | 200 |

| 2000 | 9.7 | 206.19 |

| 2000 | 9.97 | 200.60 |

| 2000 | 10.07 | 198.61 |

| 2000 | 10.12 | 197.63 |

By opting for SIP, investor would have 1003 units at an average price of `9.97. Had the investor opted for lump sum

investment of `10,000, investor would have got 1000 units at `10. SIP enables one to invest across market cycles thus

bringing the cost price down, which contributes to the returns on investment.

The above example is only for illustration purposes. It should not at any point of time be construed to

be an invitation to the public for subscribing to the units of Canara Robeco Mutual Fund Scheme.

Why Invest Systematically?

Investors tend to contemplate whether to invest right now or postpone the investment.

Well, there is no way to predict in which direction the markets will move or whether the investment is made on

the best or the worst day.

The below chart shows how staying invested for all days is beneficial than timing the markets:

Source: Internal Calculations. Data sourced from MFI explorer, ICRA online. Data from 1st April 2010-30th June 2020

Timing the Market is a High Risk Strategy...Timeless investing is the Mantra

What is STP?

Systematic Transfer Plan (STP) is a facility where in an investor can opt to transfer a fixed

amount at regular intervals from one scheme to another, at a predefined frequency.

Benefits of STP

Rising markets may tempt us to invest large sums of money in one instalment, thereby increasing the chance of losses if markets correct suddenly.

Transferring funds systematically (STP) from a scheme in one asset class to another could

not only safeguard the interests of an investor during market fluctuations, but also potentially help generate additional returns paving way for wealth creation.

MarketTiming

Investing through STP helps to avoid the risk of timing the market

Dual Benefit

Investor earns the combined returns from both the asset classes

SmartDiversification

Allocation to more than one asset class also allows one to diversify the portfolio risk

GoalBased Investing

STP aims towards fulfilment of financial goals over a period of time

RebalancingPortfolio

STP helps in rebalancing the portfolio between two asset classes being a prudent risk management practice

Who requires STP ?

To generate capital appreciation and growth over the long term, one may take STP route to transfer from a low risk product (low volatility) to a product which has potential to generate higher return.

- A person who wishes to invest lump-sum or a large amount in equities but is apprehensive of the inherent volatility in it.

- An investor having surplus in fixed term instruments or savings accounts.

- An investor who has received lump-sum as bonus from an employer, or sale of an asset or maybe a gift.

- Investors looking to tranche out their investments from low volatility - low return products to high volatility - high return products or vice versa to suit their investment goals at different life stages.

How to Start a Mutual Fund STP

To generate capital appreciation and growth over the long term, one may take STP route to transfer from

a low risk product (low volatility) to a product which has potential to generate higher return.

Let the STP strategy work smartly for your Wealth Creation over long term.

Performance of Debt & Equity Markets

Sourch: MFI Explorer, Performance as on Above graph represents the performance based on 1 year (CAGR) rolling return for the last 10 years

The information used towards formulating the graph has been obtained from sources published by third parties. While such publications are believed to be

reliable, however, neither the AMC, its officers, the trustees, the Fund nor any of their affiliates or representatives assume any responsibility for the

accuracy of such information. CRMF, its sponsors, its trustees, CRAMC, its employees, officer, directors, etc

assume no financial liability whatsoever to the user of this document.

What is SWP?

Systematic Withdrawal Plan (SWP) is a facility that allows you to

withdraw a fixed amount an existing mutual fund at a

predetermined interval.

Flexibility under SWP

An SWP is a SMARTool which allows you to withdraw fixed amount from an existing mutual fund at a predetermined interval.

SWP facility comes with flexible options whereby you can decide upon the regular cash flow based on frequency, period as well as specific amount.

How much amount do you want regularly

How Frequently you want this amount (Monthly / Quarterly)

The date till which you want to keep receiving the payouts

Benefits of SWP

Secured monthly investment plans but no stability for monthly withdrawals? Solve all your financial woes with SWP- the revolutionary

SMARTool which relieves you monthly expenses by withdrawing a fixed amount from your mutual funds.

Meet Financial Goals

Goal specific spending is planned effectively

BenefitFrom Payouts

Need based regular cash flows

SecureLifetime Support

Funding expenses after retirement

AvailTax Benefits

Potential tax efficient returns*