Start right away!

Simply fill in your details below to know more about SIP

Calculate how much your small steps today will mean in the future. Find out the expected future value of your small investments made today.

Total SIP amount invested

Growth / Appreciation

Expected investment value

Figure out the right financial amount required to achieve your financial goal through the SIP goal calculator

You would need to make Monthly SIP of

This calculator will help you visualize the amount accumulated with regular investment with an increase of your SIP amount (SIP Top-Up)

Total future value with SIP Top-up

Total amount invested

Growth / Appreciation

Expected investment value

Total future value without SIP Top-up

Total amount invested

Growth / Appreciation

Expected investment value

SIP Top-up vs SIP

than Karan

Varun

Varun

- Investment amount: `5,000 p.m.

- Investment period: Age 25– Age 35

- Continues to hold the investment till the age of 60

Karan

Karan

- Investment amount: `15,000 p.m.

- Investment period: Age 40– Age 60

Investing at different stages

Consider the following scenario wherein `5,000 is invested every month till the age of 60 years.

Even a delay of 5 years in Investments can reduce wealth considerably

The above calculation is an example only for illustration purposes, purely to explain the effect of compounding on investments over a long term.

The growth rate of the investment is assumed at 12%. Please note

the growth rate mentioned above is purely for illustration purposes only & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund

Helps to achieve financial goals

Long-term financial goals can be achieved by planning and breaking down the goals into smaller and regular investments.

Develop financial discipline

SIP is about investing a fixed amount on a fixed date of each month. This inculcates financial discipline making investors invest a fixed amount consistently at regular intervals. By starting early, even with a small amount, sizeable corpus can be built over a period of time to achieve the financial goals.

Power of compounding

Every investment made via SIP attracts returns and grows. The returns generated on the next instalment will be calculated on the previous instalments and the returns on the previous instalments. This has a snowball impact on our small investments thereby helps us generate wealth over long term.

Guilt free spending

When the investments for the financial goals are done at the start of the month through SIP, then the rest of the money can be spent as per the wants and there won’t be guilt of not utilizing or saving the money at the end of the month.

Imparts convenience

Investing through the SIP route can be done with a small amount as well; as little as ₹500 each month. SIP investments are usually auto debited from investors’ account on a specified date. With an increase in income, the amount of SIP opted for could be increased at any time.

Benefit from rupee cost averaging

Markets are volatile Taking the SIP route helps to average purchase cost and maximize returns. When markets are high, investments grow in value, however when markets are low, SIP helps accumulating more number of units. This averages out the purchase cost of the mutual fund units.

No need for timing the market

There is always a dilemma that if it is a right time to invest or not. As no one can predict market movements, investing through SIP solves this problem. Investing through SIP does not immune the investments from market volatility, but it frees from the worry of timing the markets. SIPs offer freedom from being on the constant look out for opportunities to time the market.

How SIP works?

In an SIP by investing a fixed amount at regular interval, you can take advantage of the market volatility. By investing at different NAVs the average cost per unit comes down. This is also known as Rupee Cost Averaging.

| Regular investment (`) | Unit price (`) | Units acquired |

|---|---|---|

| 2000 | 10 | 200 |

| 2000 | 9.7 | 206.19 |

| 2000 | 9.97 | 200.60 |

| 2000 | 10.07 | 198.61 |

| 2000 | 10.12 | 197.63 |

- Total investment = `10,000

- Total units purchased = 1003.03

- Average cost price = `9.97

By opting for SIP, investor would have 1003 units at an average price of `9.97. Had the investor opted for lump sum investment of `10,000, investor would have got 1000 units at `10. SIP enables one to invest across market cycles thus bringing the cost price down, which contributes to the returns on investment.

The above example is only for illustration purposes. It should not at any point of time be construed to be an invitation to the public for subscribing to the units of Canara Robeco Mutual Fund Scheme.

Why invest systematically?

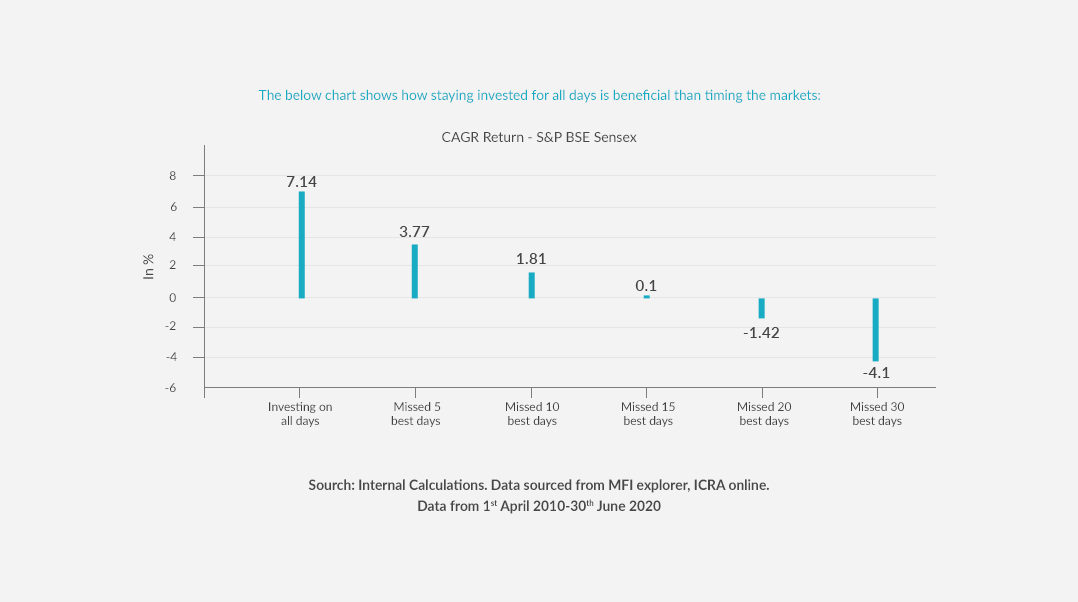

Investors tend to contemplate whether to invest right now or postpone the investment. Well, there is no way to predict in which direction the markets will move or whether the investment is made on the best or the worst day. The below chart shows how staying invested for all days is beneficial than timing the markets:

Timing the Market is a High Risk Strategy...Timeless investing is the Mantra

Investors should deal only with registered Mutual Funds, details of which can be verified on the SEBI website https://www.sebi.gov.in under ‘Intermediaries/Market Infrastructure Institutions’. Please visit http://bit.ly/cr-mandatory-disclosures to know about the process for completing one-time KYC (Know Your Customer) including process for change in address, phone number, bank details etc. Investors may lodge complaints on SCORES portal https://scores.gov.in against registered Mutual Funds if they are unsatisfied with their responses.

Subject to current Tax laws. For personal tax implication investors are requested to consult their tax advisors before investing.