Dont wan't to watch the video, read the text instead.

Raj came to office on 1st January in cheerful spirits after celebrating the New Year in gusto. The same day he received a mail from the HR department requesting for investment declaration proof. His joy immediately turned to worry ‘how do I arrange for Rs.1.5 Lakhs for investments to claim tax deductions?’ He had spent most of his salary & had hardly invested any amount during the year. He had declared investment of Rs.1.5 lakhs to claim tax deductions but could barely mange to invest Rs. 75,000 till the deadline. It was a sort of double whammy; first, he was cash-strapped since he had to invest all that was available and second, due to higher tax out-go his net salary in the last two months was quite low. Despite having a similar experience in the previous year he continued the same practice.

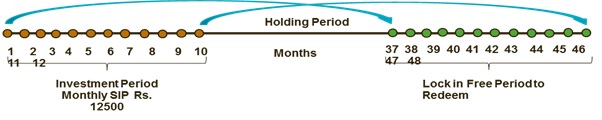

The scenario is quite common in offices. People generally declare the maximum investment ¬figures at the start of the financial year & come January they are either scurrying to collect funds for investment or their last two months salary takes a hit. Rather than struggling at the last minute one can consider small & systematic investment spread over the year. Investing a monthly amount of Rs. 12,500 allows one to meet their yearly investment target & enjoy the complete benefit of tax saving! (Monthly installment Rs.12,500 x 12 months = Rs.1,50,000)

While tax saving is important one should also strive to invest the amount prudently in order to reap maximum benefit of the savings. Thus one gains twofold i.e. decrease in tax liability plus return on investment.

Investment Avenues for Tax Saving

Under Section 80 C one can invest in PPF, NSC, Bank FDs, Life Insurance & ELSS are various investment instruments eligible for tax saving. Amongst them ELSS enjoys the shortest lock – in period of 3 Years. Also Equity Linked Saving Schemes (ELSS) allows one to benefit from the long term growth potential of equities and offers the facility to invest the amount systematically: Systematic Investment Plan (SIP)

Systematic Investment Plan (SIP): A Smart Way to Save Taxes too!

- SIP is a strategy whereby an investor commits to invest a fixed amount at specified intervals.

- SIP allows one to achieve tax saving in a systematic & hassle free manner: As a fixed amount gets invested automatically each month, the investor does not have to worry about making hasty last-minute lumpsum investments for saving tax.

- Law of Averaging at work – Rupee Cost Averaging at its best: investing the same amount on a regular basis will lead to one getting more units when price is low and one getting less units in case price is high.

- Small Ticket Sizes do not impact the wallet too!

- Focus on consistent & continuous investments – Fixed Money for Fixed Period of time to benefit from market volatility.

- Imparts Discipline in investing – The most needed quality for a long term investor.

- Each SIP would attract a 3 year lock-in period.

Invest through SIP to make Tax Planning Quick & Effortless!

Let bygones be bygones, Raj is a wiser individual if atleast for the coming financial year he signs-up for a SIP at the start of the year itself.

The above calculation is an example only for illustration purposes & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund.