ELSS can help avoid some portion of the tax deductionFind out how much you can save by investing in ELSS

-

Total tax you can save

by investing in ELSS`5,150 -

Tax payable

(before investing in ELSS)`5,150

Take your first step towards saving tax by investing in ELSS!Simply fill in your details below to know more about ELSS

What is ELSS

ELSS are diversified equity funds with a lock-in period of 3 years and offers tax benefit under Section 80C

Twin Benefit

Investment Opportunities

Tax benefit

Tax Saving under Sec80C*

Tax Free Dividends

No Tax on long Term capital gains

*Dividends are tax free as per current tax laws, that qualifies for tax exemption under section 80 C. For tax implications, investors are requested to consult their tax advisors

Exposure to equity

Lock-in helps for longer holding period

Power of compounding helps grow capital

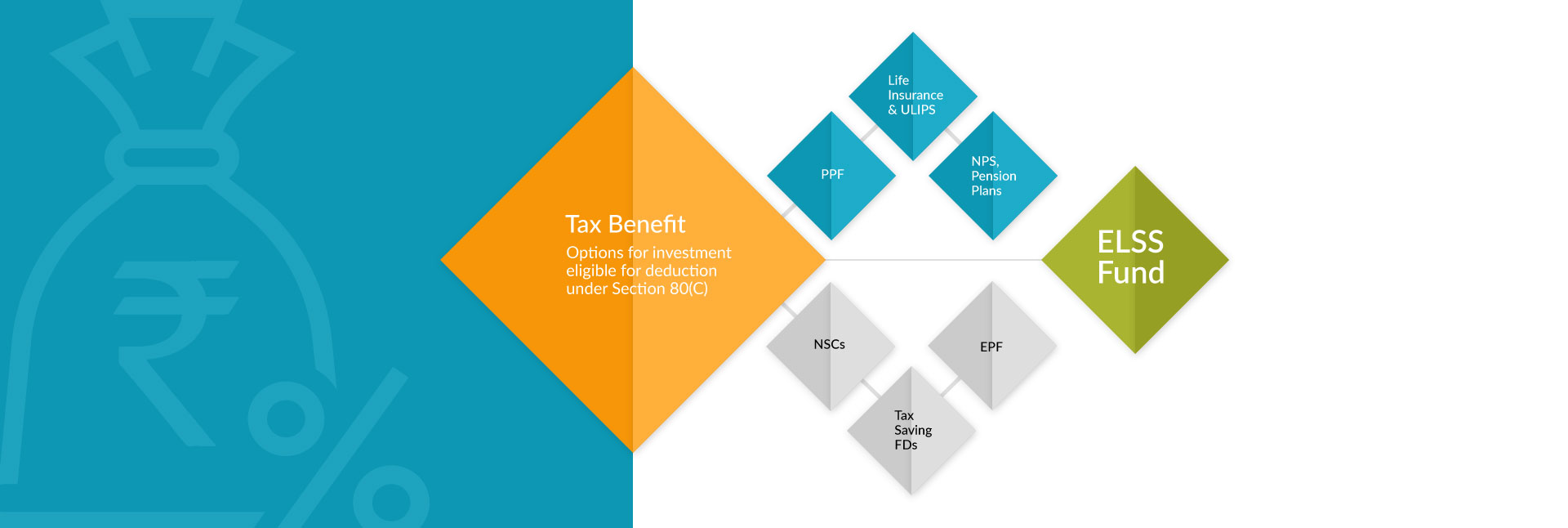

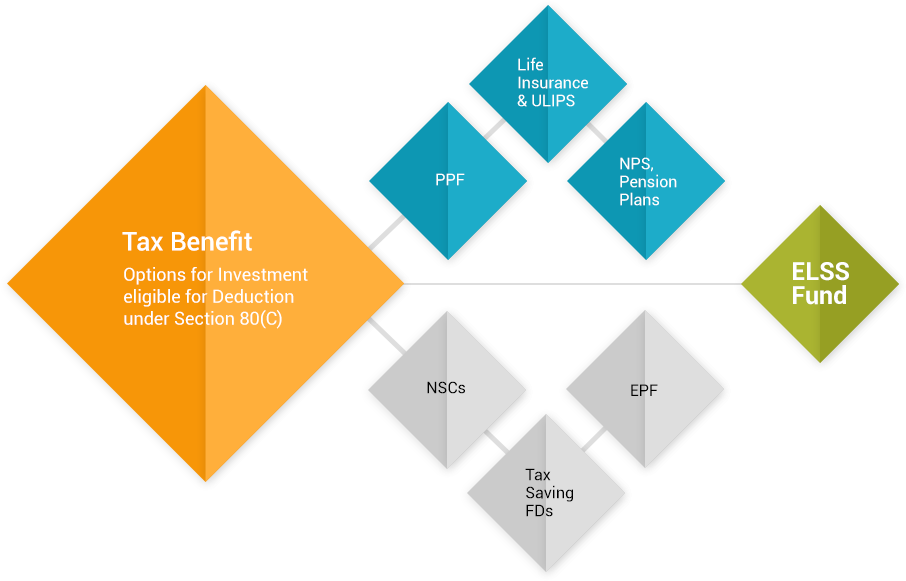

TAX SAVING

AVENUES

TAX SAVING AVENUES

Tax Saving Instruments Features

- Instruments

- Lock-in

- Dividends

- Market Linked

- Systematic Investing

- ELSS

- 3 years

- Yes

- Yes

- Available

- PPF

- 15 years

- No Dividends

- No

- Not Available

- NSC

- 5 years

- No Dividends

- No

- Not Available

- Bank FD

- 5 years

- No Dividends

- No

- Not Available

- Insurance

TraditionalULIPs

- 5 years

- No Dividends

- NoYes

- Premium payment can be done Yearly, Half yearly, quarterly, monthly

Source : India Post

Disclaimer: This list is just a representative list and not a comprehensive one. Investments in market linked products carry higher risks than non-market linked ones. Information on tax benefits are based on prevailing taxation laws. Kindly consult your tax advisor for actual tax implication before investment.

ELSS-ADVANTAGES GALORE

Tax savings:

A rupee saved is a rupee earned!

- Saving taxes is important. Tax Savings up to ` 46,800** per annum for an investment up to ` 1.5 Lakhs under Section 80 C of Income Tax Act, 1961.

- Lock-in period of 3 Years – much shorter than other tax deductible investment options

Flexible investment strategy

The longer holding period helps in compounding the returns accumulated over the lock in period of the fund

Equity markets participation

Long term investing equity market provides an opportunity to create wealth

**Assuming highest tax bracket i.e. tax rate of 30% plus 4% cess . Information on tax benefit is based on prevailing taxation laws. Kindly Consult your tax advisor for actual tax implication before investment.