Dont wan't to watch the video, read the text instead.

What is BEER Ratio?

The Bond Equity Earnings Yields Ratio (BEER) is a metric used to evaluate the relationship between bond yields and earnings yield in the stock market. The ratio has two parts- the benchmark bond yield in the numerator and the earnings yield of a stock benchmark in the denominator. A comparison of the two can be used as a form of indicator on when to buy the stocks as it measures the relative attractiveness of equities over bonds. It is also known as the Gilt-Equity Yield Ratio (GEYR).

Formula:

BEER=Bond Yield ÷ Earnings Yield

If the above formula gives a value Above 1; it indicates the stock market is said to be overvalued; If the value is Less than 1, it indicates that the stock market is undervalued. Usually, the ratio is calculated by comparing the yield of a Government Bond and the current Earnings Yield of an Index e.g. Nifty50 or BSE Sensex. (Note: Earnings yield an inverse of the Price-to-Earnings (P/E) ratio).

Interpretation of BEER:

- BEER= 1; indicate equal levels of perceived risk in the bond market and the stock market.

- BEER< 1; indicates that equities are undervalued and could be considered a good time to add allocation to equities.

- BEER> 1; means that equities is overvalued as compared to fixed income and the allocation can be considered to be lowered in equities.

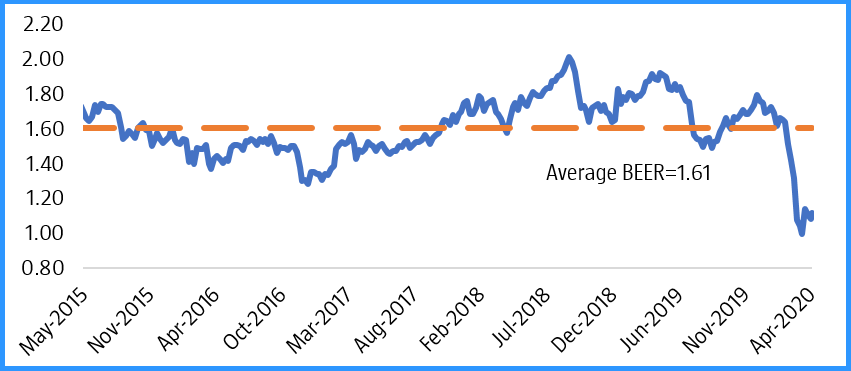

Source: Bloomberg; Note: BEER ratio compares 10-year Treasury bond yield to the earnings yield of the Nifty index; a drop in its value denotes lower equity valuations vis-a-vis bond market

E.g. During events like Demonetisation and Taper Tantrum 2012-13, BEER slipped to 1.1 level.

The earnings yield has been higher than bond yields recently for the first time since 2009. In previous instances, the same was witnessed during FY 2002-03 and FY 2008-09 which was followed by outsized returns in both the cases.

Limitations of BEER:

BEER ratio appears to have zero predictive value, based on research that was carried out on historical yields in the Treasury and Stock markets. Therefore, it cannot be used to predict any future trends. Besides, creating a correlation between stocks and bonds is said to be flawed as both investments are different in several ways:

- Government bonds are contractually guaranteed to pay back the principal whereas stocks promise nothing, and it is not considered while calculating the ratio and further interpretation from the same.

- A stock’s earnings and dividends are unpredictable, and its value is not guaranteed unlike bonds.

However, the significance of BEER cannot be undermined, especially in a scenario as this where the valuation of equity stocks is low, and the government bond yields are increasing.