Dont wan't to watch the video, read the text instead.

It’s a vicious circle we are living in today. Consumerism is big factor that deters our habit of saving as we end up spending most of our earnings. When we fall short of money, credit cards and personal loans come to our rescue. The moment we are asked about saving some money we have a standard excuse: “By the month end nothing much is left so how can we save?” As they say “Earn to spend and spend to earn”.

In this complete cycle, the most important thing we are ignoring is the future.

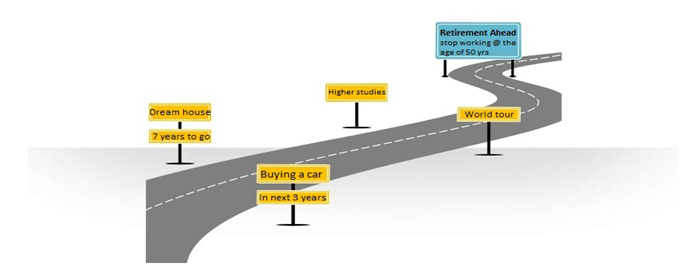

When we compare ourselves to our parents’ generation, we are going through radical changes in the way we live. Our parents’ generation took everything slow and easy but the scenario is quite different for us. The pleasure of owning a car in our 20s, pressure of buying a house in our 30s, dream of travelling across the globe, wish to provide best education for our children etc has changed the financial dynamics of an individual. To fuel all these dreams, we need money!

Imagine a scenario where your daughter is ready for her higher education, you would need Rs. 15 Lakhs for the same. If you haven’t planned for higher education, it would be a very painful exercise to arrange for money and the next best possibility is compromise.

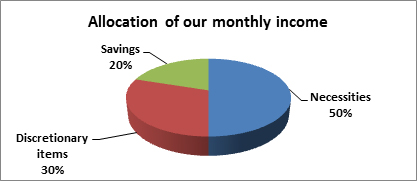

How will we manage to accomplish all that is mentioned above if we don’t have the simple habit of SAVING! Once we make-up our mind, the next question that comes is how much should be saved every month?Globally the general thumb rule for savings is;

Just investing money in anything is not going to help. Investing money is a simple but a structured process that requires discipline and patience. The money saved should be invested in the right investment products. Whether you are working as an employee, self-employed or as a businessman, your earnings are directly proportional to the amount of time you invest physically doing certain work. But investments work round the clock & do not need your physical presence to grow!!!

The purpose of investing should be to fulfill your dreams and this could be termed in a simple way as “Financial goals”. Without a goal or purpose, you might not save at all or use up the funds for wrong reasons.

End Goal of any investment is to give you Financial Freedom! Reach the financial goals without any stress or sense of burden.