Dont wan't to watch the video, read the text instead.

Rehaan has decided to invest in a pool of debt funds. He has looked at the past performance of debt funds and shortlisted the same starting from the best performing fund. After reading the risk disclaimer, “Past performance of the Sponsors, AMC/Fund does not indicate the future performance of the Schemes of the Fund”, Rehaan is confused. If past performance is not the only factor for selecting debt funds, then what are the factors to be considered while selecting debt funds?

1. Assets Under Management (AUM) and Average Maturity:

The size of the fund (AUM) might not make a big difference while investing in equity funds. But in case of liquid funds and Ultra short term funds, AUM plays an important role. Fund managers handling funds with higher AUM would have extra head room to buy relatively longer term debt papers which would contribute to marginally higher returns. The portfolio maturity is represented by Average Maturity of the fund. Higher average maturity refers to the fact that fund is holding on to longer term debt papers compared to other debt funds.

| Funds | Net Assets (Cr) | Average Maturity (Yrs) | 1-Year Return (%) |

|---|---|---|---|

| H Liquid Fund | 25633.80 | 0.08 | 8.21 |

| R Liquid Fund | 5396.69 | 0.08 | 8.19 |

| I Liquid Fund | 26149.74 | 0.07 | 8.19 |

|

C Liquid Fund |

2203.32 | 0.04 | 8.08 |

“H Liquid fund” holds papers with longer maturity. This could be one of the reasons for higher returns from the fund.

An investor needs to be aware of the fact that as average maturity increases the interest rate risk (market risk) of the fund also increases. Whenever there is a sudden change in interest rates, funds with higher average maturity would be more sensitive towards the change than the funds with lower average maturity.

2. Credit quality of the portfolio:

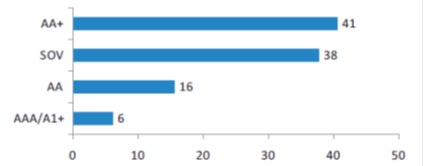

Credit quality in debt funds is based on the debt papers/bonds held by the funds. The debt instrument’s credit quality is measured by credit rating given by rating agencies. AAA is the highest rating given followed by AA, A and so on. As the credit rating goes down, the credit risk of the investment increases.

Illustration: Sample credit profile of a debt fund

Debt papers with higher credit risk offer higher rate of return to compensate for the risk. Credit rating of the portfolio is another key contributing factor in the fund returns.

| Fund | Net Assets (Cr) | Average Maturity (Yrs) | 1-Year Return (%) | Average Credit Quality |

|---|---|---|---|---|

| F Liquid Fund |

3053.6 |

0.09 | 8.38 | AA |

| H Liquid Fund | 25633.8 |

0.08 |

8.21 | AAA |

| R Liquid Fund | 5396.69 |

0.08

|

8.19 | AA |

| I Liquid Fund | 26149.74 | 0.07 | 8.19 | AAA |

| C Liquid Fund | 2203.32 | 0.04 | 8.08 | AAA |

In the above given illustration, “F Fund” has invested in longer term paper (represented by higher average maturity) and average credit quality of the portfolio is AA. Because of these two factors the “F Fund” has given highest possible return among other funds.

3. Interest rate view – Specifically for duration management funds:

View on the interest rate is one of the most important factors to be looked at before investing into funds like Bond/Income funds and Gilt Funds. There is an established thumb rule which states:

The most important factor that influences interest rate is inflation. When inflation is in upward trend, to keep inflation under check, RBI increases the policy rates (like REPO, Reverse REPO, CRR, SLR etc). When the policy rate goes up, so does the over-all interest rate. This results in bond prices going down. The medium and long term debt funds tend to give negative returns.

When the inflation is cooling down, the anticipation from the market is that RBI would reduce the rates. A fund manager would like to buy long term bond to take advantage of such a scenario. If inflation and interest rates are expected to come down in near term, it makes sense to buy a fund with higher modified duration.

The bond prices appreciate when interest rates go down thus helping the debt fund to appreciate With inflation and interest rates going up, it’s safe to invest in funds with lower modified duration.