Dont wan't to watch the video, read the text instead.

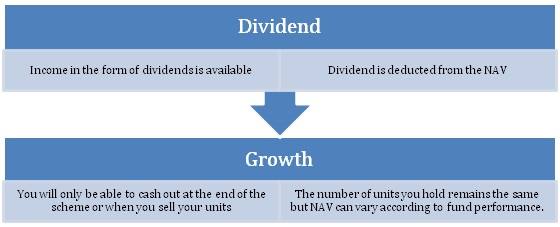

You have decided to take advantage of the tremendous flexibility that mutual funds offer. Congratulations. One such flexibility offered is whether you want to receive income from your mutual fund investment or let your income remain invested till you cash out of the scheme. While the former is called ‘dividend option’, the latter is called ‘growth option’. Let’s understand both these options better.

Dividend option offers you regular income. Dividends are distributed by the fund depending on the distributable surplus that the scheme has accumulated. As an example, if you own 1,000 units of a mutual fund and the fund declares a dividend of Rs. 3 per unit, you will get Rs. 3,000 as ‘dividend in an equity oriented scheme‘. However, in other schemes, the scheme would have to pay a Dividend Distribution Tax (DDT) and hence the dividend you receive would be lesser by that amount. The Net Asset Value (NAV), which reflects the realisable value that you will get if you sell your mutual fund investment, will fall proportionally and get readjusted after the dividend is paid. (Note: The NAV in reality may not fall exactly to the extent of dividend declared. NAV is also impacted by changes in prices of securities invested in.)

The declared dividend may also be re-invested by buying additional units of the scheme. The dividend amount would automatically be utilized to buy additional units which would be added to your existing holdings. For example, the Rs. 3,000 dividend received in the above case would be reinvested as below:

| Existing unit holdings | 1,000 units |

| Dividend amount | Rs. 3,000 |

| NAV of scheme after dividend | Rs. 17 |

| No. of additional units purchased | 176.471 units (3000/17) |

| Total units held after dividend reinvestment | 1176.471 units |

The above table is for illustration purpose only & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. Past performance may or may not be sustained in the future.

Growth option on the other hand, does not offer you any regular income; instead all the money that the scheme generates from its investments is simply put back into it in order to generate capital over time. So this means that you will always have the same amount of units that you purchased when you entered the scheme. The NAV of the scheme keeps changing according to fund performance.

Taxation on dividend and growth options

One of the key differences between the dividend and growth options is tax.

Dividend option: Dividends received on your investment in equity funds are tax-free. However, dividends received on non-equity funds are taxed; here, the mutual fund has to pay the tax and then distribute the net amount as dividends.

Growth option: In case of choosing the growth option, the following tax implications may arise due to capital gains. If you hold your equity mutual fund investment for more than a year, the profits are not taxed and are termed as long term capital gain. If held for less than a year, it is termed as short term capital gain and is taxed at 15%.

In case of non-equity funds, if you hold for more than 3 years, the profits are termed as long term capital gain (taxed at a lower rate); otherwise, they are termed as short term capital gain (taxed at a higher rate).

Choosing between Dividend and Growth Options

Choosing between dividend and growth options is a matter of individual choice and needs. It may also depend on whether you are investing in equity or debt funds. However, it is best to keep in mind that if you are an investor with a need for regular income, it is best to opt for the dividend option. You will get an element of liquidity from your investments, as some of the money that you invested will flow back to you regularly. If your aim is to let your money grow in the long term, choose the growth option. In the growth option you get the benefit of compounding as the returns on your investment are reinvested, this is not the case in the dividend option.