Dont wan't to watch the video, read the text instead.

Once we are convinced about the fact that savings and investments are essential, the next logical step is to decide where to and how much to invest. An individual needs to define his/her financial goals and put them in the order of priority. This would ideally be the first step prior to deciding where to and how much to invest. The financial goals in order of priority could be;

Corpus meant for Emergency

Retirement

Buying a Car & House

Children’s Higher education

To begin with, corpus required for emergency purposes should be the first saving to be done even beforeyou start investing. It could be the total amount required for running the monthly expenses for the period of 4-6 months. Once the emergency corpus is set aside, further investments should be made to meet other financial goals. The SIP investments should ideally be linked to specific financial goals.

Experts always recommend that the amount to be invested in an SIP is dependent on an individual’s financial goals. The SIP amount should ensure that at the time of realizing the financial goal, the corpus accumulated through the SIP is sufficient enough to meet the goal.

How to determine a financial goal?

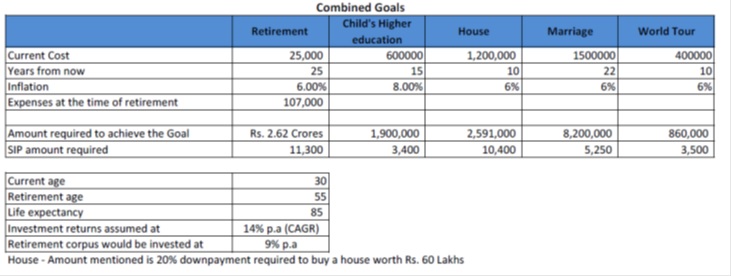

First step is to ascertain the current cost of the proposed goal. For instance the current cost of engineering is Rs. 600,000/- in the city of Bangalore. If the child would go for higher education 15 years from now and assuming the cost of education is escalated by 8% p.a., an individual would need close to Rs. 19 Lakhs then to meet the goal of child’s higher education.

To get this Rs. 19 lakhs in 15 years, one can look at starting an SIP Rs. 3400/- pm approximately in a mutual fund scheme with an assumed rate (CAGR) of 14% p.a.

This looks good and right when we isolate a financial goal and arrive at how much SIP amount is required for getting there. Only when we start defining all the goals and put a plan around it, can we save appropriately for all our goals.

Combining financial goals:

Goal based planning is the right way to approach investments. Hence, the right SIP amount should be based on the financial goals. As per the below mentioned illustration, if an individual arrives at a complete financial plan and start investing based on the financial goals he would need close to Rs. 33850/- on a monthly basis in Mutual fund SIPs to achieve the financial goals

The only challenge would be where to get SIPs of Rs. 33,850/- every month. If an individual who is 30 years of age and is spending Rs. 25,000/- towards monthly expenses, might not have so much surplus on a monthly basis. This situation could lead an individual to believe that this is not easy and he/she would start thinking about investing once he/she starts earning more. Larger sums of money in the form of SIP might just scare people away.

Power of human capital:

The biggest advantage we have is that our income level doesn’t remain same throughout. It increases almost every year. Aon Hewitt salary survey of 2014-15 states the in India the salaries have grown at an average of 11.80%p.a over the last 15 years (from 2001-2015) even after factoring recessionary and slow down years.

So our income increases year on year. As per the thumb rule, even if we start saving 15% of our income, our investment would also start increasing every year. Keeping this in mind, even if an investor starts a smaller sum in an SIP and constantly increases by say 10% every year,he/she might just reach the financial goals without burdening the current finances.

Incremental SIP:

As per the illustration given above, an individual who is 30 years old would require 2.62 crores at the age of 55 to manage her retirement. To get the desired corpus, she will have to invest Rs. 11,300/- in SIPs every month. This SIP of Rs. 11,300/- would only be directed towards retirement goal and she will have to save much more for other goals.

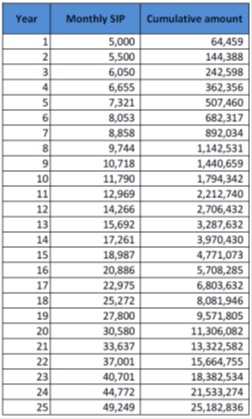

As per our incremental SIP method, she can start a smaller amount of SIP but such amount should be increased by 10% every year. If she starts an SIP of Rs. 5000/- every month with an assumed rate of 14% p.a and increase the SIP amount by 10% for next 25 years, the corpus accumulated would be close to Rs. 2.52 crores. Since the increase in SIP is gradual and in line with the increase in the income levels, the retirement goal looks achievable.

To sum up, what is the right SIP amount, first step is to determine the financial goal. Start a small amount of SIP, but ensure the SIP amount is increased consistently in line with increase in income.

Start small, but start early!

The above table is for illustration purpose only & shall not be construed as indicative yields/returns of any of the Schemes of Canara Robeco Mutual Fund. Past performance may or may not be sustained in the future.