Dont wan't to watch the video, read the text instead.

Process of Investing in Mutual Funds:

-

Know Your Customer (KYC): It is mandatory for any investor to get the KYC done before dealing in Stocks, Mutual Funds, Portfolio Management Services etc. This is a onetime exercise, done through SEBI registered intermediary (Mutual Fund advisors, brokers, Mutual Funds etc). Furnishing PAN is mandatory for mutual fund transactions except for Micro SIP investors (investing less than Rs. 50,000/- in a FY in mutual funds).

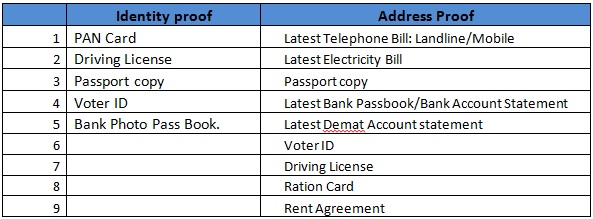

Any of the documents in each of the category should be submitted for completion of KYC formalities:

The documents like bills and statements should be not more than 3 months prior to the date of application.

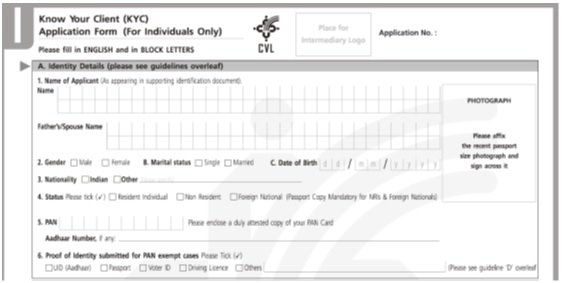

Along with the above said Identity proof and address proof document, a prospective investor should submit the photograph along with the KYC application form. The documents and the form must be submitted in physical form, this process cannot be completed online.Preview of the KYC form:

The form can be downloaded from this location: http://www.amfiindia.com/know-your-customer

-

Investing in Mutual Funds:

Off-line: Once the KYC formalities are completed, a prospective investor could use the service of a financial intermediary called as Mutual Fund Distributor, walk into the office of the Mutual Fund Company directly or the office of the Registrar & Transfer Agents. Mutual Fund distributors could be Banks, Non Banking Finance companies or Individual Financial Advisors. The required documents are:

- Mutual Fund application form duly filled up

- KYC Number

- Payment instrument – Cheque or Demand Draft. Cash deposit challan incase the AMC is accepting Cash

Based on the application submitted, the Mutual Fund Company would allot the Folio Number which represents the investment account held by the investor. The details of the investment would be furnished in “Account Statement”, which would talk about date of investment, unit purchase price, number of units held and current value of the portfolio etc.

Online: KYC formalities should have completed before investing in Mutual funds. Not all the mutual funds would allow new investors to start investing online. To invest in mutual funds online, a client needs to visit website of the Mutual Fund Company or AMC and complete the registration online. Online login and password would be created, using which investments and other transactions could be done.

-

In Person Verification (IPV): In addition to KYC formalities, IPV is an additional requirement mandated from January 1, 2012. This means any SEBI registered intermediary - NISM & AMFI certified distributors who are ‘Know Your Distributor’ (KYD) compliant, are authorized to conduct In Person Verification (IPV). For conducting an IPV, the intermediary while completing the KYC formalities would not only collect the documents like Identity proof and Address proof but also physically verify the same. The copy of documents collected must be attested by the intermediary after verifying with the original documents.