You will receive a call within 24 business hours (8 AM to 9 PM, except Sundays)

Canara Robeco Manufacturing Fund

Thematic - Manufacturing - An open-ended equity scheme following Manufacturing theme

<div class="table-responsive"> <table class="table table-bordered k-table" style="margin-bottom:0;"> <thead> <tr> <th colspan="3"> <p class="font12" style="font-weight:400;"><strong>This product is suitable for investors who are seeking*</strong> </p> </th> </tr> </thead> <tbody> <tr> <td> <div> <ul class="TextMiddle"> <li> <p class="font12">Long term capital appreciation</p> </li> <li> <p class="font12">Investments in equity and equity related instruments of companies engaged in the manufacturing theme </p> </li> </ul> </div> </td> <td><img alt="" src="/Investor-assets/images/06-Very-High.jpg" style="padding-left:3rem;" /> <h3 class="secTitle fixedside" style="text-align:center;">Scheme Risk-o-meter </h3> </td> <td><img alt="" src="/Investor-assets/images/Very%20High%20Risk..png" style="padding-left:3rem;" /> <h3 class="secTitle fixedside" style="text-align:center;">BENCHMARK RISK-O-METER<br /> Nifty India Manufacturing TRI</h3> </td> </tr> </tbody> </table> </div>

-

Risk

Very High RiskThis product is suitable for investors who are seeking *

Long term capital appreciation

Investments in equity and equity related instruments of companies engaged in the manufacturing theme

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

-

AUM(in Cr)

-

Age

since 11-Mar-2024 -

Horizon

-

Goal

-

Benchmark and it's Risk-O-Meter

Nifty India Manufacturing TRIRiskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

Performance

- Annualized Returns

- Absolute Returns

This Scheme

This Scheme

- Different plans shall have different expense structure. In case of return calculated the IDCW(dividend) option, it is assumed that IDCW(dividend) declared under the schemes have been reinvested at the prevailing NAV

- Past performance may or may not be sustained in future and same may not necessarily provide the basis for comparison with other investment

- Load is not considered for computation of returns

- Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement. In case, the start/end date of the concerned period is a non-business day, the NAV of the previous date is considered for computation of returns

- The data of the last working day has been considered for the calculation of performance

- Wherever TRI data since inception for benchmarks is not available, benchmark performance is calculated using composite of CAGR and TRI values of the benchmark

- The performance of the schemes is benchmarked to the Total Return variant of the Index

- For lumpsum investments, if the investment period is less than 1 year then same return values are displayed for absolute & XIRR. For periods above 1 year, they are annualized. 1 Year is assumed as 365 days.

- Returns for investments in dividend plans of schemes are calculated after assuming that the net dividend payouts post statutory taxes & levies, are re-invested back in the scheme.

- Dividends declared from benchmark's constituents isn't taken into account when comparing with investment in scheme's dividend plans.

- Performance is always compared against the latest benchmark of the scheme irrespective of the date of change of scheme's benchmark, if any.

- Except when SIP tenure is since inception, for all tenures, the start day for SIP investments is considered as 1st of every month. There is no end date to SIPs for the purpose of graphs.

- For the purpose of NAV date applicability, if the investment date happens to be a non-business day, next business day's NAV is applied. Investment on inception date can happen on a non-business day.

- For lumpsum investments, if the investment period is less than 1 year then same return values are displayed for absolute & XIRR. For periods above 1 year, they are annualized. 1 Year is assumed as 365 days.

- Returns for investments in dividend plans of schemes are calculated after assuming that the net dividend payouts post statutory taxes & levies, are re-invested back in the scheme.

- Dividends declared from benchmark's constituents isn't taken into account when comparing with investment in scheme's dividend plans.

- Performance is always compared against the latest benchmark of the scheme irrespective of the date of change of scheme's benchmark, if any.

- Except when SIP tenure is since inception, for all tenures, the start day for SIP investments is considered as 1st of every month. There is no end date to SIPs for the purpose of graphs.

- For the purpose of NAV date applicability, if the investment date happens to be a non-business day, next business day's NAV is applied. Investment on inception date can happen on a non-business day.

Fund Managers

-

{{item.Title | htmlToPlaintext}}

Investment Objective

Scheme Documents

Historical Returns

Comparative performance of

- Dividend History

- As per SEBI

DIVIDEND DISTRIBUTED

- For lumpsum investments, if the investment period is less than 1 year then same return values are displayed for absolute & XIRR. For periods above 1 year, they are annualized. 1 Year is assumed as 365 days.

- Returns for investments in dividend plans of schemes are calculated after assuming that the net dividend payouts post statutory taxes & levies, are re-invested back in the scheme.

- Dividends declared from benchmark's constituents isn't taken into account when comparing with investment in scheme's dividend plans.

- Performance is always compared against the latest benchmark of the scheme irrespective of the date of change of scheme's benchmark, if any.

- Except when SIP tenure is since inception, for all tenures, the start day for SIP investments is considered as 1st of every month. There is no end date to SIPs for the purpose of graphs.

- For the purpose of NAV date applicability, if the investment date happens to be a non-business day, next business day's NAV is applied. Investment on inception date can happen on a non-business day.

| CAGR since Inception | |||

| 1 Year | |||

| 3 Year | |||

| 5 Year | |||

| Current Value of 10,000 invested at inception | ` | ` | ` |

Why you should invest

Other information

-

Minimum Investment

-

Entry Load: Nil

-

Exit Load

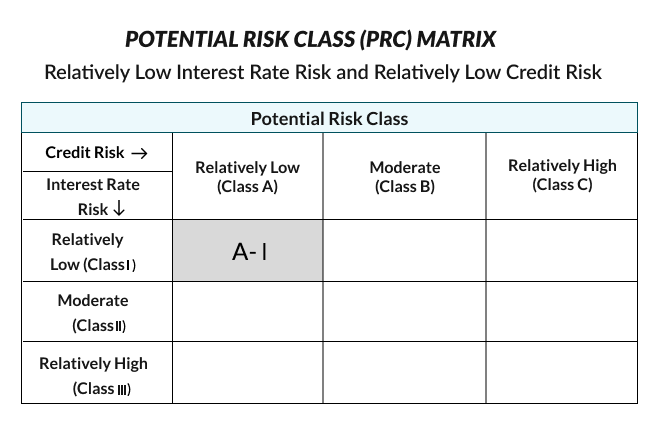

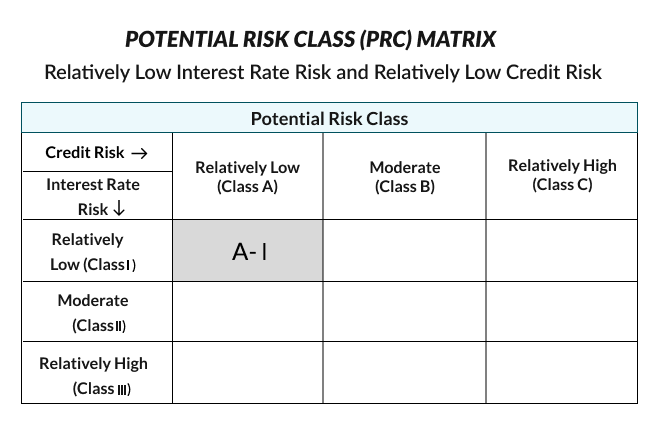

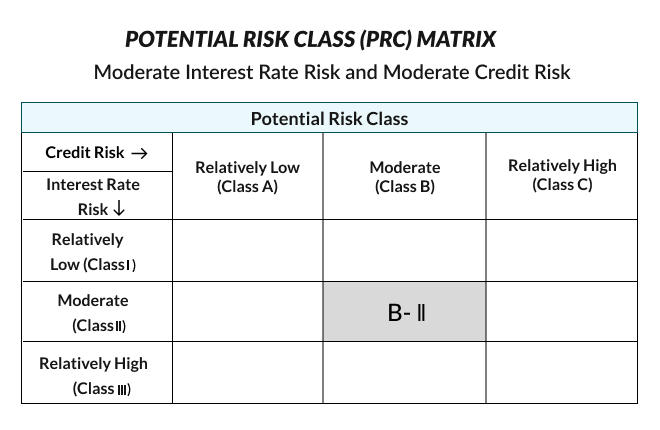

Prescribed Asset Allocation

-

Equity and Equity-related Instruments of companies engaged in Manufacturing theme : 80% to 100% (Very High)

-

Equity and Equity-related Instruments of companies other than engaged in Manufacturing theme: 0% to 20% (Very High)

-

Debt and Money Market Instruments: 0% to 20% (Low to Moderate)

-

Units issued by REITs and InvITs: 0% to 10% (Very High)

*Note: Under normal circumstances, the asset allocation of the Scheme will be as per the above table. Investors are requested to refer SID for more information on Asset Allocation.

Current Asset Allocation*

-

Equities97.37%

-

Debt Instruments0.00%

-

Government Bonds0.00%

-

Money Market0.00%

-

Others2.63%

Asset Allocation as on

Portfolio Statistic

Portfolio

Market Capitalization

Sector Allocation

Top 10 Holdings % of Total

Note – Scheme may or may not have any future position in the above Sectors(s) / Stock(s) / Issuer(s)

Credit Rating Profile

Instrument Break-up

Top 10 instruments by holding % of Total

View Similar Funds

NAV As on 25-Mar-2025

59.32-0.12 (-0.20%)CAGRSince Inception

12.96%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investing predominantly in equities and equity related instruments of large cap companies

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

100.55-0.71 (-0.70%)CAGRSince Inception

16.02%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investing in equity and equity related securities of companies following the Consumption and Financial Theme

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

161.83-0.54 (-0.33%)CAGRSince Inception

18.81%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investment in equity and equity related securities with a statutory lock in of 3 years and tax benefit

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

237.04-2.91 (-1.21%)CAGRSince Inception

17.10%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investing predominantly in equities and equity related instruments of both large cap and mid cap companies

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

311.6-1.31 (-0.42%)CAGRSince Inception

17.31%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investment in equity and equity related instruments across large cap, mid cap, small cap stocks

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

18.46-0.02 (-0.11%)CAGRSince Inception

17.22%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investment in equity and equity related securities across market capitalisation in maximum 30 stocks.

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

144.75-1.51 (-1.03%)CAGRSince Inception

14.83%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investing in equities and equity related instruments of companies following the Infrastructure Theme

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

14.99-0.13 (-0.86%)CAGRSince Inception

19.13%Very High Risk

This product is suitable for investors who are seeking *

Long term capital appreciation

Investments predominantly in equity and equity related instruments of mid cap companies.

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

13.16-0.10 (-0.75%)CAGRSince Inception

17.99%Very High Risk

This product is suitable for investors who are seeking *

Long term capital appreciation

Investment in equity and equity related instruments across large cap, mid cap, small cap stocks

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

34.78-0.36 (-1.02%)CAGRSince Inception

22.63%Very High Risk

This product is suitable for investors who are seeking *

Capital appreciation over long term

Investing predominantly in equities and equity related instruments of small cap companies

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.

NAV As on 25-Mar-2025

17.03-0.09 (-0.53%)CAGRSince Inception

16.14%Very High Risk

This product is suitable for investors who are seeking *

Long term capital growth.

Investment in equity and equity related instruments by following value investing strategy.

Riskometer

* Investors should consult their financial advisers if in doubt above whether the product is suitable for them.