Focus Funds

NAV As on 03-Apr-2025

234.43-0.85 (-0.36%)CAGRSince Inception

17.01%NAV As on 03-Apr-2025

58.42-0.15 (-0.26%)CAGRSince Inception

12.82%NAV As on 03-Apr-2025

34.730.08 (0.23%)CAGRSince Inception

25.48%NAV As on 03-Apr-2025

125.84-0.22 (-0.17%)CAGRSince Inception

14.01%

Canara Robeco

Capital Protection Oriented Fund-Series 2 (PlanA)

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Funds Suitable for Takers

Dont

know

your risk

profile?

NAV As on 03-Apr-2025

3740.63552.76 (0.07%)CAGRSince Inception

6.81%Low to Moderate Risk

NAV As on 03-Apr-2025

234.43-0.85 (-0.36%)CAGRSince Inception

17.01%NAV As on 03-Apr-2025

143.710.34 (0.24%)CAGRSince Inception

14.77%NAV As on 03-Apr-2025

1318.347410.20 (0.02%)CAGRSince Inception

4.97%NAV As on 03-Apr-2025

18.17-0.04 (-0.22%)CAGRSince Inception

NANAV As on 03-Apr-2025

17.720.02 (0.11%)CAGRSince Inception

NANAV As on 03-Apr-2025

3095.6931.70 (0.05%)CAGRSince Inception

6.96%Low to Moderate Risk

NAV As on 03-Apr-2025

41.41390.03 (0.08%)CAGRSince Inception

7.33%Low to Moderate Risk

NAV As on 03-Apr-2025

75.3633-0.11 (-0.14%)CAGRSince Inception

8.32%NAV As on 03-Apr-2025

101.10.06 (0.06%)CAGRSince Inception

16.03%NAV As on 03-Apr-2025

54.95420.00 (0.01%)CAGRSince Inception

7.85%NAV As on 03-Apr-2025

29.3055-0.04 (-0.14%)CAGRSince Inception

7.02%NAV As on 03-Apr-2025

93.9521-0.04 (-0.04%)CAGRSince Inception

10.88%NAV As on 03-Apr-2025

307.21-0.86 (-0.28%)CAGRSince Inception

17.22%Compare Schemes ( Select only 3 Schemes )

Get in touch if you need assistance with understanding our offerings, planning your investments or completing transactions

Please call on1800-209-2726

OR

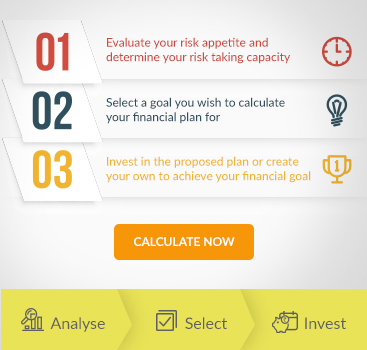

Systematic Investment Planning

In a world of automations, Automating our savings and investing removes the potential for making poor decisions about the timing of purchases. Calculate the value of your investments via Systematic Investment Plan over a period of time.

SIP Future Value CalculatorFrom the desk of Fund Manager

Mr. Shridatta Bhandwaldar

Head - Equities

In the month of Nov’23, equity markets gave applaudable returns with Nifty 50 gaining by 5.52% on m-o-m basis following upbeat quarter end earning numbers, U.S. Federal Reserve kept interest rates on hold for the third consecutive time, fall in global crude oil prices and strong GDP data in the second quarter of FY’24 added to the gains.

Foreign Institutional Investors (FIIs) were net buyers in Indian equities to the tune of ₹ 9000.88 crores.

Goods and Services Tax (GST) shows highest ever collection of ₹1.68 lakh crore for Nov’23, 15% more than the corresponding period of last year and this points towards the growing trajectory of the Indian economy. The gross GST collection surpassed the mark of Rs. 1.60 lakh crore for the sixth time in FY’24.

The combined index of eight core industries increased by 12.1% in Oct’23 as compared to 0.7% in Oct‘22. The production of all Eight Core Industries recorded positive growth in Oct’23 over the corresponding month of last year.

Globally, US Equity Markets also went north amid expectations from investors that the U.S. Federal Reserve will cease raising interest rates. Additionally, there was reduction in fears about violence in the Middle East following Israel and Hamas's agreement to a ceasefire mediated by Qatar. European equity markets too rose on slightly easing geopolitical tensions and better than expected Eurozone business activity for Nov’23 data. Asian equity markets closed on a mixed note amid continuing concerns about the Chinese economy. Remarks from a Bank of Japan representative that it was too early to discuss policy normalization added to the losses.

Source: ICRA MFI Explorer

Mr. Avnish Jain

Head - Fixed Income Macro Backdrop: Intensifying geopolitical strife has flung a pall of uncertainty around the global economy as it slows in the final quarter of 2023, albeit with considerable cross-country variations.

Source: **ICRA MFI Explorer, Bloomberg, RBI, MOSPI.