You will receive a call within 24 business hours (8 AM to 9 PM, except Sundays)

- Home

- FAQ's

- Transactional FAQ's

- eNACH

FAQs

1. What is E-Mandate?

E-Mandate is a payment service initiated by RBI and the National Payments Corporation of India (NPCI). It provides the underlying infrastructure for businesses to collect recurring payments in India. With E-Mandate / NACH mandate, one can easily authorize recurring payments by using their Netbanking or Debit card credentials.

2. Why has E-Mandate been introduced?

To set up a systematic investment plan (SIP), an investor can either submit physical post dated cheques or give a bank mandate for auto debit of the SIP instalment amount. Setting up debit mandate takes long and the SIP takes up to 30 days.

To reduce the paperwork and time involved in setting up a debit mandate, registrars of mutual funds have introduced E-Mandate for investments. The E-Mandate facility actually digitizes the entire process. It therefore offers a very simple and hassle-free solution for mutual fund investors and also for mutual fund distributors. The entire time cycle for registering mandates for SIPs is reduced from 3-4 weeks to just about 2-3 days in case of E-Mandates of mutual funds.

3. What are the pre-requisites of registering an E-Mandate?

◾ E-Mandate facility is only available for mutual fund holders who hold these funds in single mode, or solo mode as it is called. Joint holders of mutual funds cannot avail E-Mandate as of now.

◾ E-Mandate has to be electronically signed and authenticated by one’s biometric Aadhar number.

◾ The mobile number registered for the E-Mandate should be the same as the one registered for Aadhar.

◾ It has to be ensured that the PAN number is updated in all respects and the same PAN is mapped to the Aadhar card and to the mutual fund investments.

◾ The bank mandate provided for the E-Mandate must also be Aadhar verified. Otherwise the E-Mandate will not be possible.

◾ E-Mandate facility is available only for the banks that are enabled for such payments under the National Payment Council of India (NPCI). Most of the large banks in India are already NPCI registered.

◾ Currently, there is a maximum cap of Rs. 1 lakh for investments via the E-Mandate facility.

4. What are the steps an investor of Canara Robeco Mutual Funds can follow to register for E-Mandate?

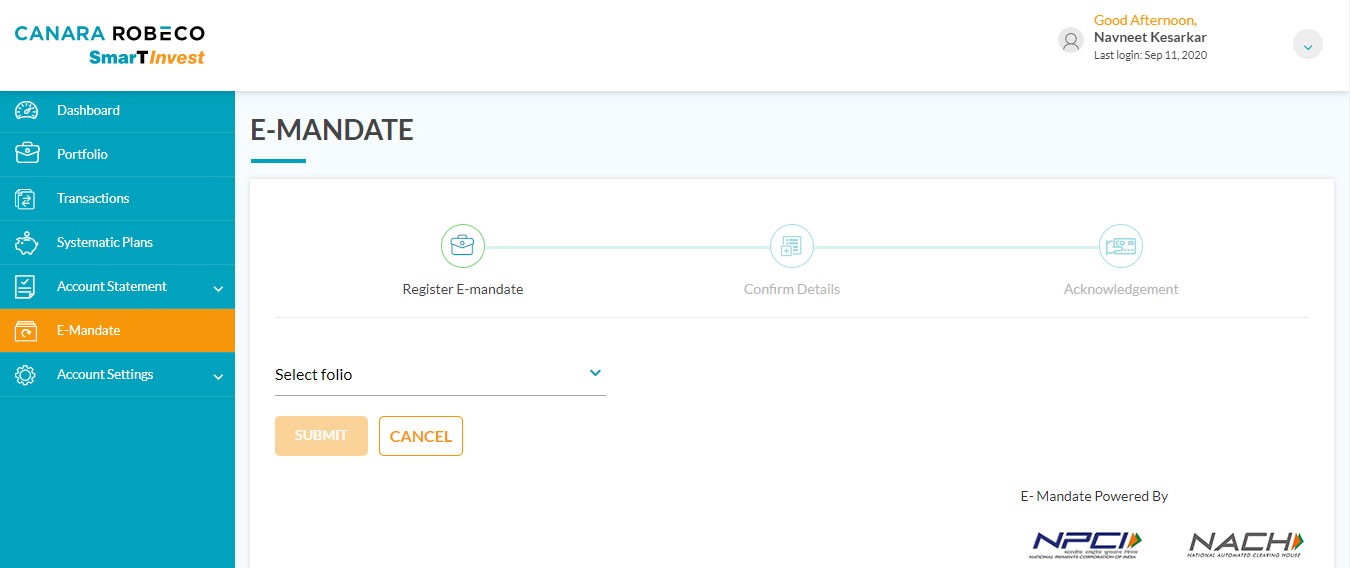

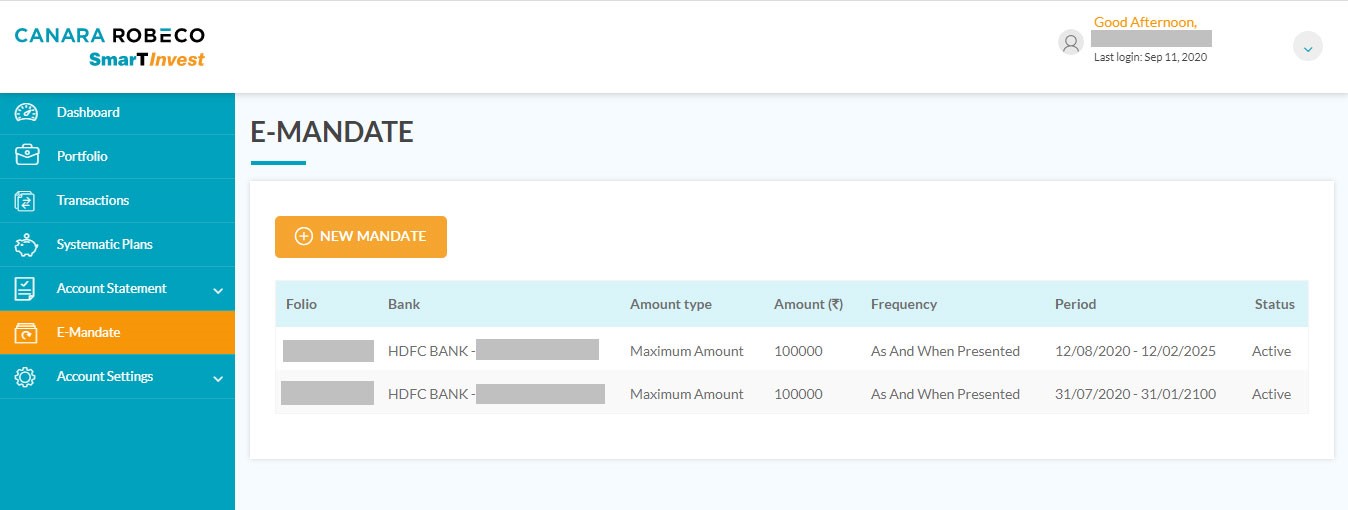

An existing investor can log in to the SMartInvest portal (https://www.canararobeco.com/smart-invest/sign-in/) and can choose the option in the home page. The investor will then have to select the folio no from the drop-down list.

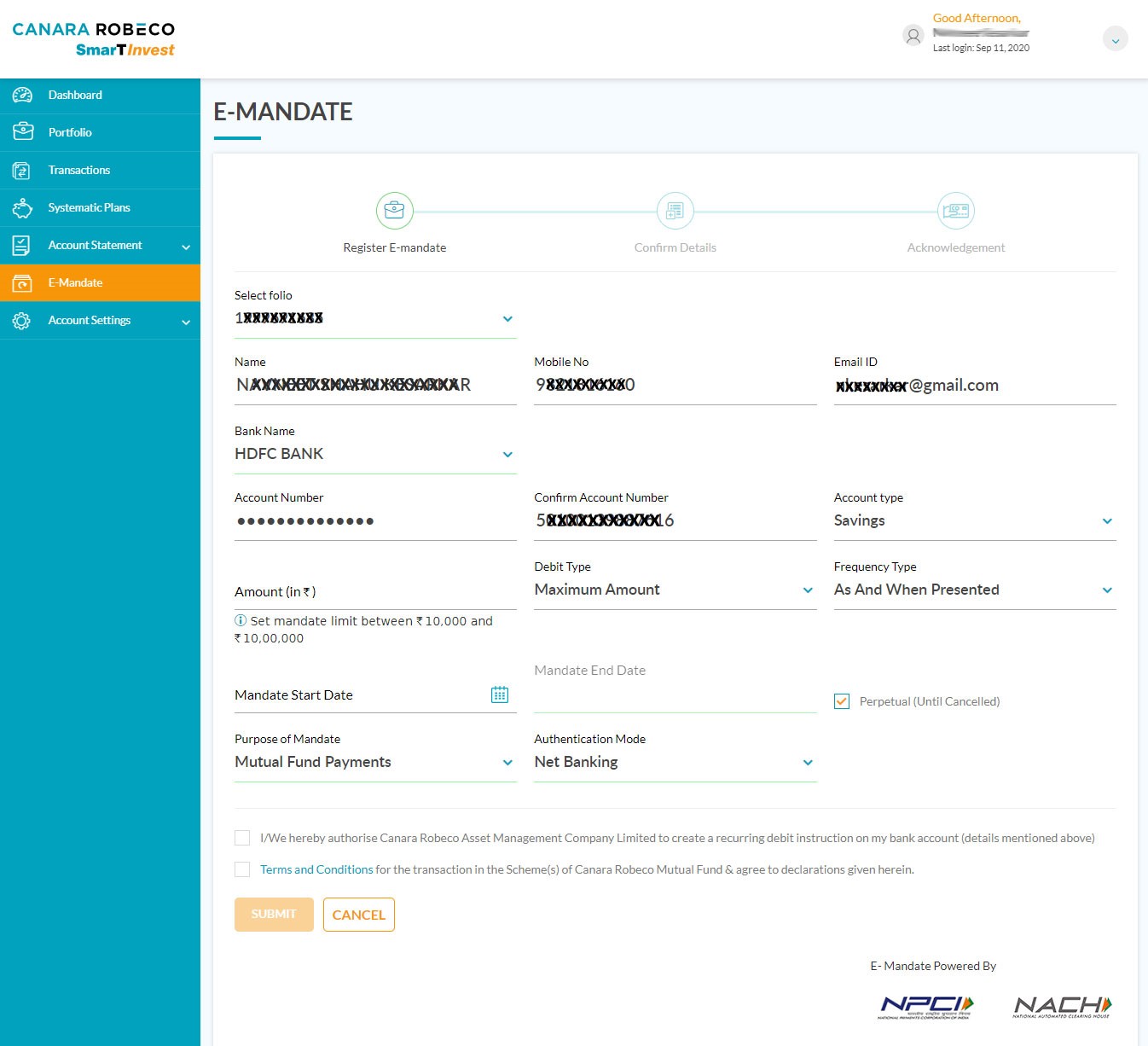

Once the folio no is selected the basic information like name, mobile no, email ID registered with the folio will appear. The bank registered with the folio has to be selected from the drop-down list and the account no and type of account will have to be fed. Also, the debit type and frequency type have to be selected from the drop-down lists.

The mandate start and end have to be selected and if the investor wishes to keep the end date as perpetual then he/she can select the box for Perpetual.

The authentication mode also has to be selected. It can be either net banking or debit card details.

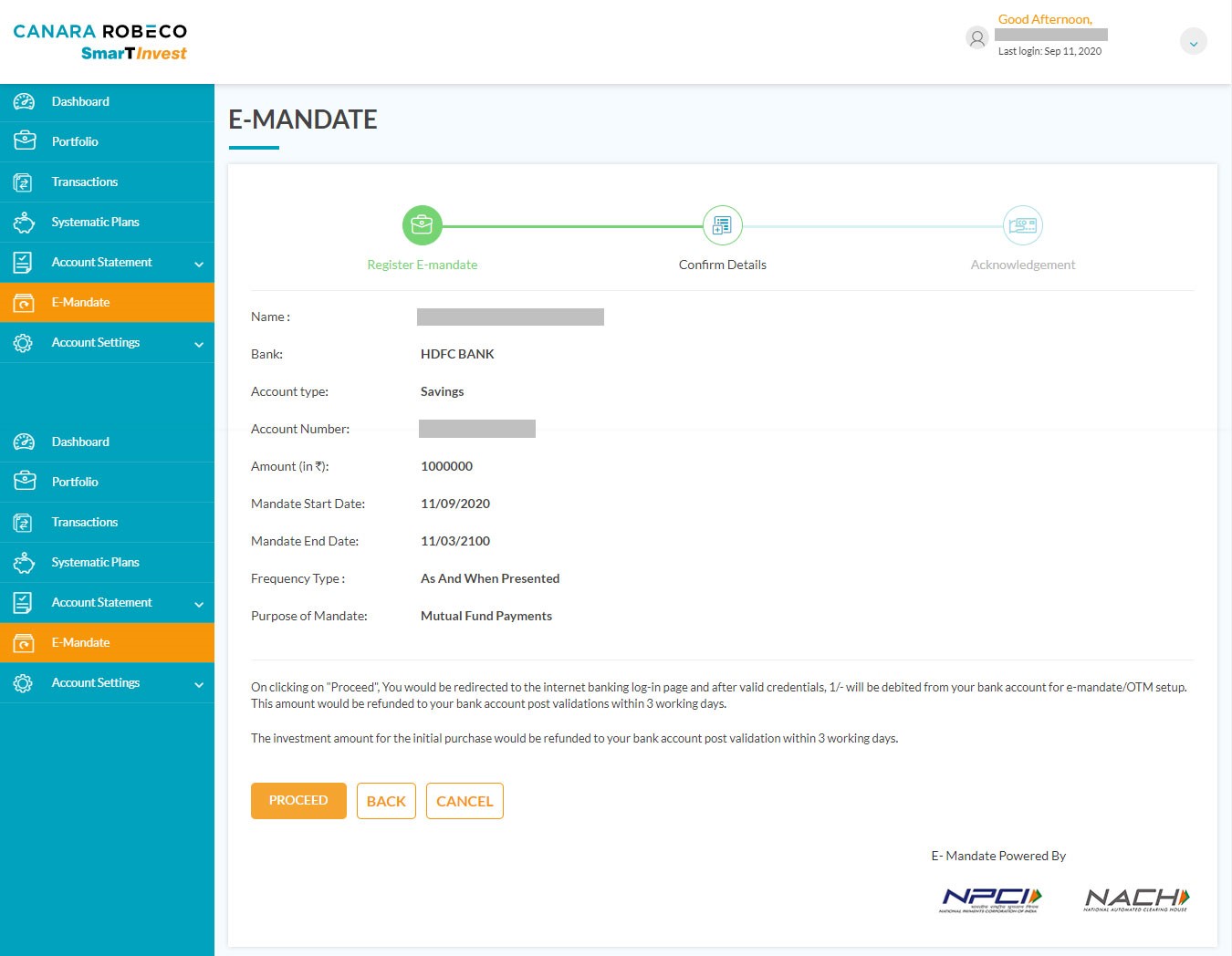

Once the terms and conditions are accepted and authorisation is given for recurring debit instructions, the user will be directed to the below page which will display all the information which were fed in the previous step and need to be proceeded.

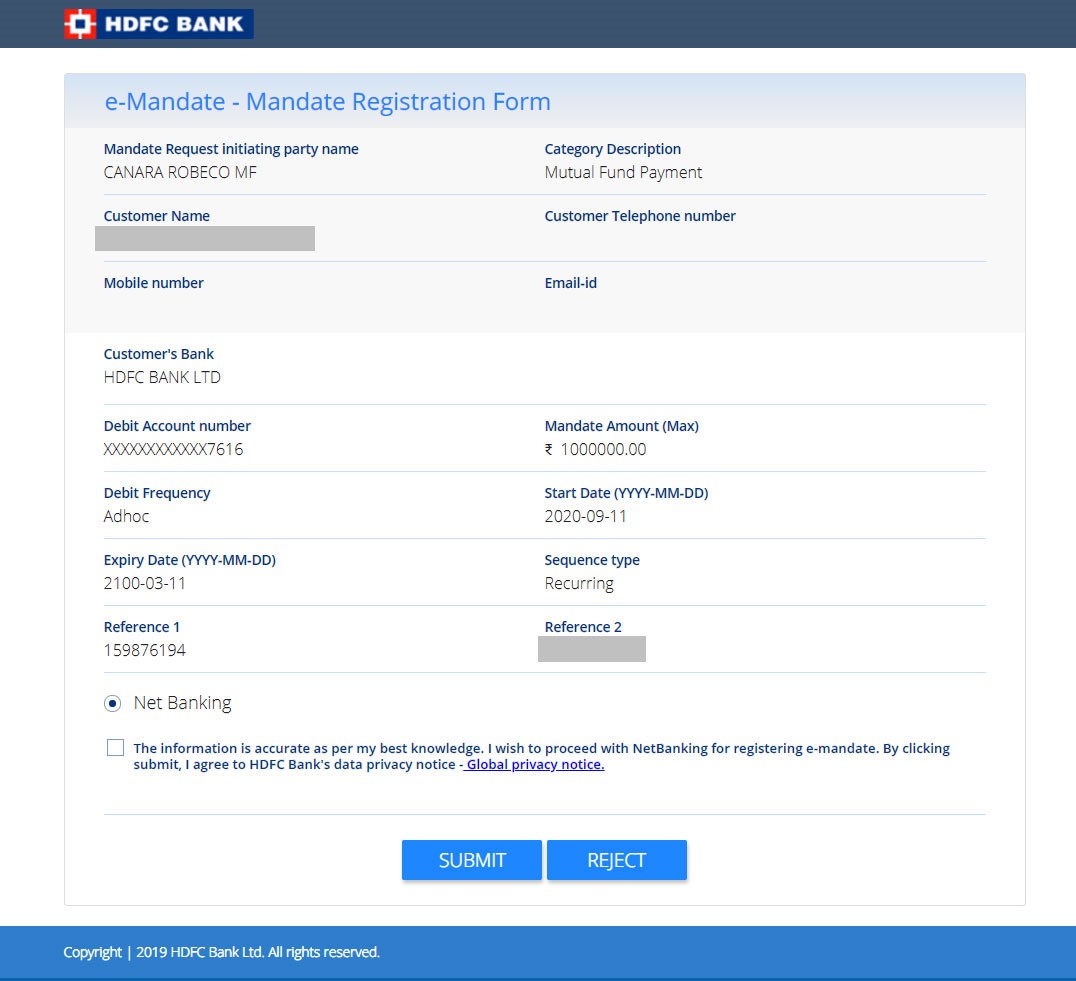

After clicking the ‘Proceed’ button, the following page will appear with all the information based on the inputs in the previous step and the accuracy of which needs to be authenticated by clicking on the box.

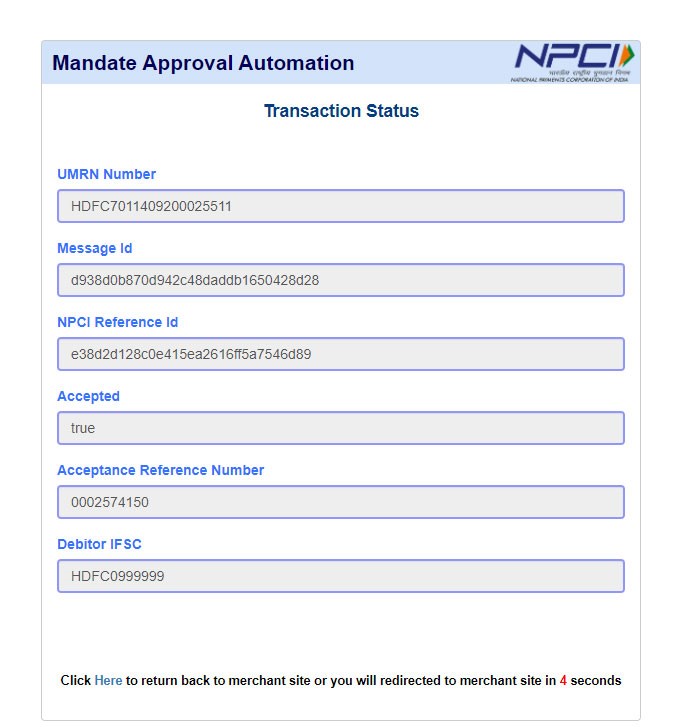

The next page will give the transaction status giving a confirmation of the completion of the process.

5. What are the advantages of E-Mandate?

◾ The entire process is totally digital and there is no involvement of any physical forms or signatures required at any point of time.

◾ The E-Mandate can be registered within 2-3 days and the SIP can commence in less than 7 days. This is a far cry from the present system where the SIP registration takes close to a month.

◾ E-mandate is a process that is less prone to errors and physical delays. When a physical mandate is sent, there is the risk that the mandate could get rejected by the bank due to signature mismatch or by the registrar for technical reasons. E-Mandate resolves most of these problems.

Compare Schemes ( Select only 3 Schemes )

Consent for Candidates on the Career page:

×Thank you for evincing interest to join Canara Robeco AMC. As part of the application process, we collect and process personal data from candidates to facilitate the recruitment and hiring process.

This consent form outlines how we collect, use, and protect your personal information.

By submitting your application and providing personal data through our careers page, you acknowledge and consent to the following:

- Information Collection: We may collect various types of personal information, including but not limited to your name, contact details, resume, cover letter, employment history, educational background, and other relevant information submitted through the application process.

- Use of Information: The information you provide will be used for recruitment and hiring purposes only. It will be accessed by our HR and hiring teams to assess your qualifications and suitability for the position for which you have applied.

- Data Retention: We will retain your personal data for as long as necessary to fulfill the purposes for which it was collected or as required by applicable laws and regulations. If your application is unsuccessful, we may retain your data for future opportunities with your consent.

- Data Security: We take appropriate measures to ensure the security and confidentiality of your personal information. Access to your data is restricted to authorized personnel involved in the recruitment process.

- Third-Party Disclosure: Your personal information may be disclosed to third parties with your consent, except as required by law.

- Data Subject Rights: You have the right to access, correct, update, or delete your personal information at any time. If you wish to exercise any of these rights, please contact us using the below form.

By providing your consent, you confirm that you have read and understood the terms outlined in this document and that you agree to the processing of your personal data as described herein.

If you do not agree with these terms, please do not proceed with the application process on our careers page.

Thank you for considering Canara Robeco AMC as your potential employer.